Realty Investment in New York: A Comprehensive Overview

New York has long been a prime destination for real estate investment, supplying a vast array of possibilities from its bustling city facilities to its beautiful upstate areas. The state's diverse property market permits capitalists to check out numerous techniques, whether it's household rentals, industrial homes, or deluxe advancements. Whether you're a skilled investor or new to the marketplace, understanding the dynamics of property financial investment in New York is critical to optimizing returns.

In this write-up, we'll explore why New York is an appealing area genuine estate investment, emphasize key locations to take into consideration, and offer tips for navigating the marketplace.

Why Buy New York Real Estate?

1. Solid and Diverse Economic Situation

New york city's economic situation is one of the largest on the planet, driven by markets such as financing, modern technology, media, medical care, and tourist. The economic strength and diversity create a stable real estate market that attracts both domestic and worldwide financiers. In cities fresh York City, Rochester, and Albany, the need for property and industrial residential properties continues to be high as a result of the influx of specialists, companies, and students.

2. High Rental Demand

New york city, particularly New york city City, experiences a continually high demand for rental homes. With a large populace of occupants-- including specialists, trainees, and young households-- there are constantly possibilities for steady rental revenue. In metropolitan locations, apartment, condominiums, and multi-family homes produce significant cash flow due to the ongoing requirement for rental housing. Also outside the city, locations like Long Island, Westchester, and the Hudson Valley experience rental need driven by commuters and those aiming to stay in even more economical yet well-connected locations.

3. Building Recognition Potential

While the New York property market can be costly, it is known for its potential long-lasting recognition. Historically, residential property values in New York City and its surrounding areas have actually revealed consistent growth. Even upstate, where property rates are a lot more budget-friendly, particular areas like Albany and Buffalo have seen residential or commercial property worths boost as a result of revitalization efforts and new developments.

4. Selection of Investment Opportunities

New York offers a wide range of investment possibilities, from high-end luxury homes in Manhattan to extra economical single-family homes in suburban or upstate areas. Capitalists can pick from domestic, commercial, industrial, or mixed-use buildings, depending on their investment objectives. This range makes New york city an attractive market for different kinds of investors, from those looking for capital through rental residential properties to those looking for long-lasting recognition.

Trick Areas for Real Estate Investment in New York City

1. New York City City

New York City City is one of the most competitive and dynamic realty markets worldwide. Regardless of its high rates, it remains a location for financiers because of its durable rental market and worldwide allure. Trick locations to take into consideration include:

Manhattan: Recognized for deluxe homes, business realty, and prime office. Manhattan provides high returns however additionally calls for significant funding.

Brooklyn: Popular for household realty financial investments, specifically in gentrifying communities like Williamsburg, Greenpoint, and Bushwick.

Queens: Areas like Long Island City and Astoria are proliferating, offering more budget-friendly financial investment chances contrasted to Manhattan and Brooklyn.

The Bronx: With revitalization efforts underway, The Bronx is coming to be a brand-new frontier for investors seeking growth potential in an emerging market.

2. Long Island

Long Island supplies a mix of country living and seaside attractions, making it appealing for family members and experts. Financiers can locate chances in residential realty, particularly in https://sites.google.com/view/real-estate-develop-investment/ the areas like Huntington, Hempstead, and Riverhead. Rental demand is solid, especially in locations close to the Long Island Rail Roadway, which gives hassle-free access to New york city City.

3. Westchester Region

Westchester Area is prominent among commuters who operate in New York City but like a quieter rural lifestyle. Towns like White Plains, New Rochelle, and Yonkers use outstanding real estate chances, particularly in the household market. The demand for rental homes in this region is solid due to its closeness to the city, good institutions, and growing service centers.

4. Hudson Valley

The Hudson Valley has actually become an significantly popular area for real estate financial investment due to its scenic charm, distance to New York City, and economical property costs. Towns like Green Springs Capital Group Sign, Newburgh, and Kingston are experiencing growth as even more individuals seek to get away the high costs of the city while still being within commuting range. The area uses a mix of residential, getaway, and business residential or commercial properties, making it an eye-catching selection for investors trying to find both temporary cash flow and long-lasting recognition.

5. Upstate New York City

Upstate New York, especially cities like Albany, Syracuse, Rochester, and Buffalo, provides possibilities for investors searching for more budget friendly real estate. These areas have seen revitalization efforts, making them appealing for property, business, and commercial investments. Upstate also has strong rental demand because of the existence of colleges, medical care centers, and expanding technology industries.

Investment Techniques for New York City Property

1. Buy-and-Hold Approach

The buy-and-hold strategy is one of the most popular investment approaches in New York. This involves purchasing a residential or commercial property, renting it out, and holding onto it for the long term to benefit from property appreciation. This strategy functions well in locations with solid rental need, such as New York City, Long Island, and Westchester. Investors can create easy revenue with rental repayments while waiting on the residential or commercial property's value to increase with time.

2. Fix-and-Flip Approach

Financiers searching for quicker returns may opt https://sites.google.com/view/real-estate-develop-investment/ for the fix-and-flip approach. This includes acquiring homes in need of improvement, making improvements, and after that offering them for a profit. Brooklyn, The Bronx, and parts of upstate New York are prime markets for fix-and-flip financial investments, where properties can be purchased a lower cost, remodelled, and cost a greater value.

3. Business Realty Investment

Industrial homes, such as office complex, retail areas, and industrial properties, provide significant returns for capitalists in New York. The business realty market in locations like Manhattan, Brooklyn, and even parts of upstate New york city stays solid. Investors in this market can gain from long-term leases with stable occupants, creating regular capital.

4. Multi-Family Homes

Multi-family homes, such as duplexes or apartment, are an excellent alternative for financiers seeking to create regular rental earnings. In locations like Queens, The Bronx, and Buffalo, multi-family homes remain in high demand. These buildings not just provide higher capital but likewise spread out the threat by having multiple occupants in one structure.

Tips for Success in New York Realty Financial Investment

Do Thorough Marketing Research: Understand the particular market you're buying, whether it's Manhattan deluxe condos or upstate houses. Each location has its one-of-a-kind dynamics and cost patterns.

Collaborate With Local Professionals: New York's realty market can be intricate. Companion with local real estate agents, brokers, and residential property supervisors that have comprehensive knowledge of the area you're targeting.

Secure Financing: New York real estate can be expensive, so having solid funding in position is critical. Discover alternatives like traditional mortgages, hard cash loans, or partnering with other investors to secure resources.

Understand Neighborhood Regulations and Rules: Each area in New york city has its very own policies concerning zoning, property taxes, and rental laws. Be sure to understand these lawful factors to consider prior to purchasing.

Realty financial investment in New York provides a wealth of possibilities for those wanting to develop riches via property ownership. From the competitive markets of New york city City to the promising regions of upstate New York, capitalists can select from a range of investment approaches to suit their economic objectives. By meticulously looking into the market, leveraging local knowledge, and focusing on locations with strong need, financiers can take advantage of New York's vibrant real estate landscape for lasting success.

Judge Reinhold Then & Now!

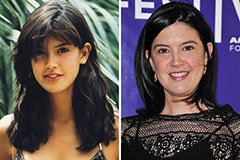

Judge Reinhold Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!